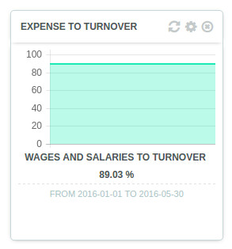

Expense to Turnover

Expense to Turnover

Overview

This widget shows the ratio between one of your EXPENSE accounts and your total Operating Income over a period of time.

Calculation

For example, if your total operating income from the 1st of Jan up to the 30th of May is 45,151.05 AUD and your Wages and Salaries expenses for the same period is 40,200.00 AUD, the calculated ratio will be:

40,200.00 / 45,151.05 = 89.03%

Settings

You can change the selected account and time period in the settings section (top-right cogwheel).

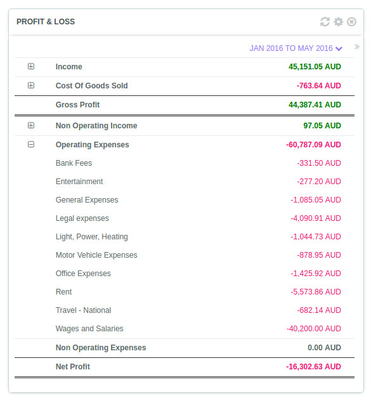

Verify it in Impac! (Profit and Loss widget)

In Impac!, the Profit and Loss widget can be used to verify what exactly stands behind the calculated ratio.

- The Turnover is equivalent to the Income line in the Profit and Loss widget.

- The Account's Expense Amount (Wages and Salaries in the example) can be found by expanding the account's breakdown on the left-hand panel of the Profit and Loss widget ("+" sign on the left).

Make sure the same time period is selected for both the two widgets.

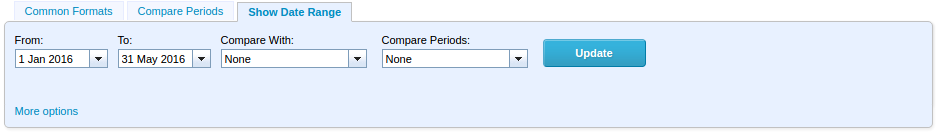

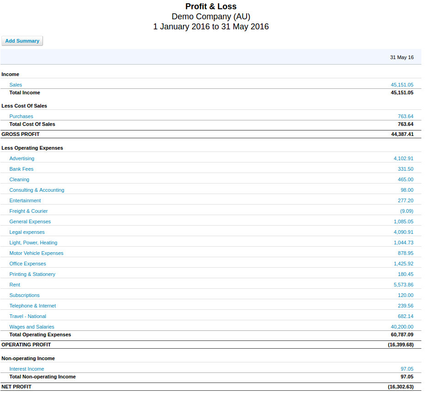

See it in Xero

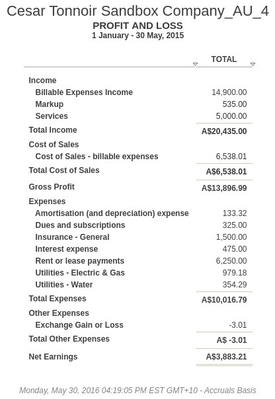

The Xero Profit and Loss report can be used: Menu > Reports > All Reports > Profit and Loss.

Exactly as per Impac! Profit and Loss widget:

- The Turnover is equivalent to the Total Income line in the report.

- The Account's Expense Amount (Wages and Salaries in the example) can be found in the report's accounts breakdown.

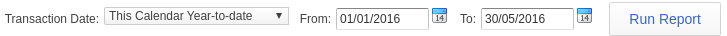

The time range in Xero must match the one selected in the widget:

Noticeable differences with the Impac! widget

The calculation done by Impac! does not exist in Xero and has to be done manually based on the Profit and Loss report results.

See it in QuickBooks

The Profit and Loss report can be used: Menu > Reports > Profit and Loss.

- The Turnover is equivalent to the Total Income line in the report.

- The Account's Expense Amount can be found in the report's accounts breakdown.

The time range in QuickBooks must match the one selected in the widget:

Noticeable differences with the Impac! widget

The calculation done by Impac! does not exist in QuickBooks and has to be done manually based on the Profit and Loss report results.

Related content

Any question? Contact us on support@maestrano.com