Cash Summary

Cash Summary

Overview

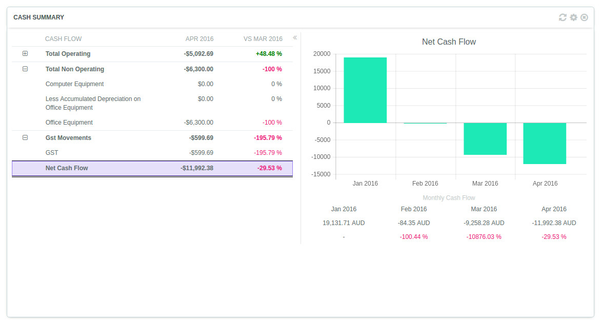

Calculates the cash flow for a given period of time. The cash flow history detail can be displayed on the right panel by click an element of the list on the left panel.

The percentage is showing the cash in or cash out evolution compared to the previous period. The values on the left panel shows the cash flow calculation for the current period (current month on the screenshot), while the right panel values correspond to the values of the selected element for all the different periods of the scope.

The time range can be changed in the settings.

Calculation

- Non operating accounts correspond to the fixed assets accounts.

- GST movements accounts corresponds to the "sales tax payable" current liabilities accounts.

- Operating accounts are accounts of classifications EXPENSE, REVENUE, and all the other current liabilities accounts.

The report simply calculates the amount of cash-in our cash-out for all the selected accounts, for a period, compared with the previous period.

Settings

Time period can be changed in the settings section (top-right cogwheel).

See it in Xero

In the Xero menu: Reports > Cash Summary.

The period in Xero should be of the same size of the period set in Impac!:

1 month if the period in Impac! is “monthly”

3 months if the period in Impac! is “quarterly”

12 months if the period in Impac! is “yearly”

The “Compare with” setting in Xero should match the time range setting in Impac!.

The date in Xero should correspond to the end date picked in Impac!, and the checkboxes should be all unticked.

Noticeable differences with the Impac! widget

Negative numbers are displayed in accounting format in Xero - with parenthesis.

See it in MYOB AccountRight

Cash Summary can be compared against the MYOB Statement of Cash Flow located under Reports > Index to Reports > Banking > Statement of Cash Flow.

The selected date in MYOB AccountRight report has to match the period selected in Impac!.

Noticeable differences with the Impac! widget

MYOB AccountRight considers partially paid invoices and bills as fully paid in the Statement of Cash Flow, leading to discrepancies with Impac!. When partially paid, Impac! will apply pro-rata based amount on GST collected and paid, whereas MYOB AccountRight will consider the full invoice amount in the GST collected and paid.

Any question? Contact us on support@maestrano.com