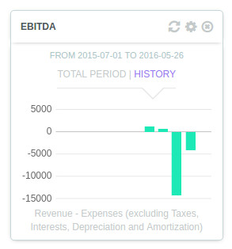

EBITDA

EBITDA

Overview

This widget is calculating the EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) of the company and its evolution in time.

The accounts types and subtypes are used to determine if the account’s balance has to be deducted from the total.

Calculation

Formula used: Revenue accounts excluding Interests - Expenses accounts excluding Taxes, Interests, Depreciations and Amortizations.

The figure in the "total period" mode corresponds to the total of all the transactions related to the selected accounts over the selected period: it is obtained by summing all the "bars" of the history chart.

Settings

Time period can be changed in the settings section (top-right cogwheel)

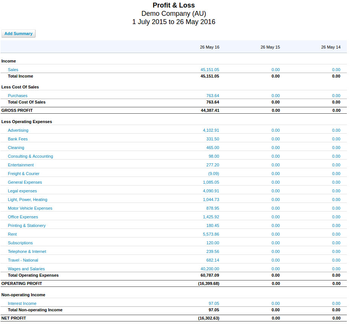

See it in Xero

The Profit and Loss report in Xero can be used to retrieve the EBITDA (equivalent to "Net Profit").

This can be accessed by clicking Reports > Profit and Loss.

See it in QuickBooks

The Profit and Loss report in QuickBooks can be used to retrieve the EBITDA (equivalent to "Net Income").

Make sure that the time periods selected in Impac! and in QuickBooks are the same.

Related content

Any question? Contact us on support@maestrano.com